“The things you own

end up owning you”

– Tyler Durden, Fight Club (1999)

“So you must be very cautious when you buy something for the long term – a car, a house, a stock, a mutual fund – whatever. Because like it or not, the buying decisions you make today will influence some of your choices and behavior in the future.”

BEFORE YOU SCROLL ANY FURTHER…

So, listen..

I’ve created this site because I couldn’t find the one I needed – unpretentious, simple, and the one not afraid of offending me when truth demanded it. We will all benefit from some tough-love sometimes. I’m hoping you’d find that bitter medicine here in my opinion posts.

The educational posts? They are only for that purpose – explaining things in the simplest possible terms. Terms so simple that your neighborhood kid – the one that rings your bell and runs away – could understand if you read them to him (provided you catch him first).

Tyler Durden made me take a close, hard look at my life. I am carrying that spirit. Every once in a while, I’d love for you to take take a look at your financial choices and ask one question – “Will it make my life better?” If yes, go ahead. If no, then screw that and do something else. Do not be afraid to challenge and reject anyone, when it’s irrelevant to you.

Paraphrasing Tyler Durden again – “This is your life, and you’re building it one decision at a time.”

Got feedback? Send me an email on prathamesh@phronesia.tech.

Want me to cover a topic? Submit your topic request.

If you can handle truth-bombs without tearing up, subscribe below. Only relevant posts will come your way, not everything.

Browse posts by topic categories

Insurance & Protection

You’re probably working very hard to earn money. But are you sure you won’t have to spend it for emergencies? How well have you protected it? Check out this section to understand and decide for yourself.

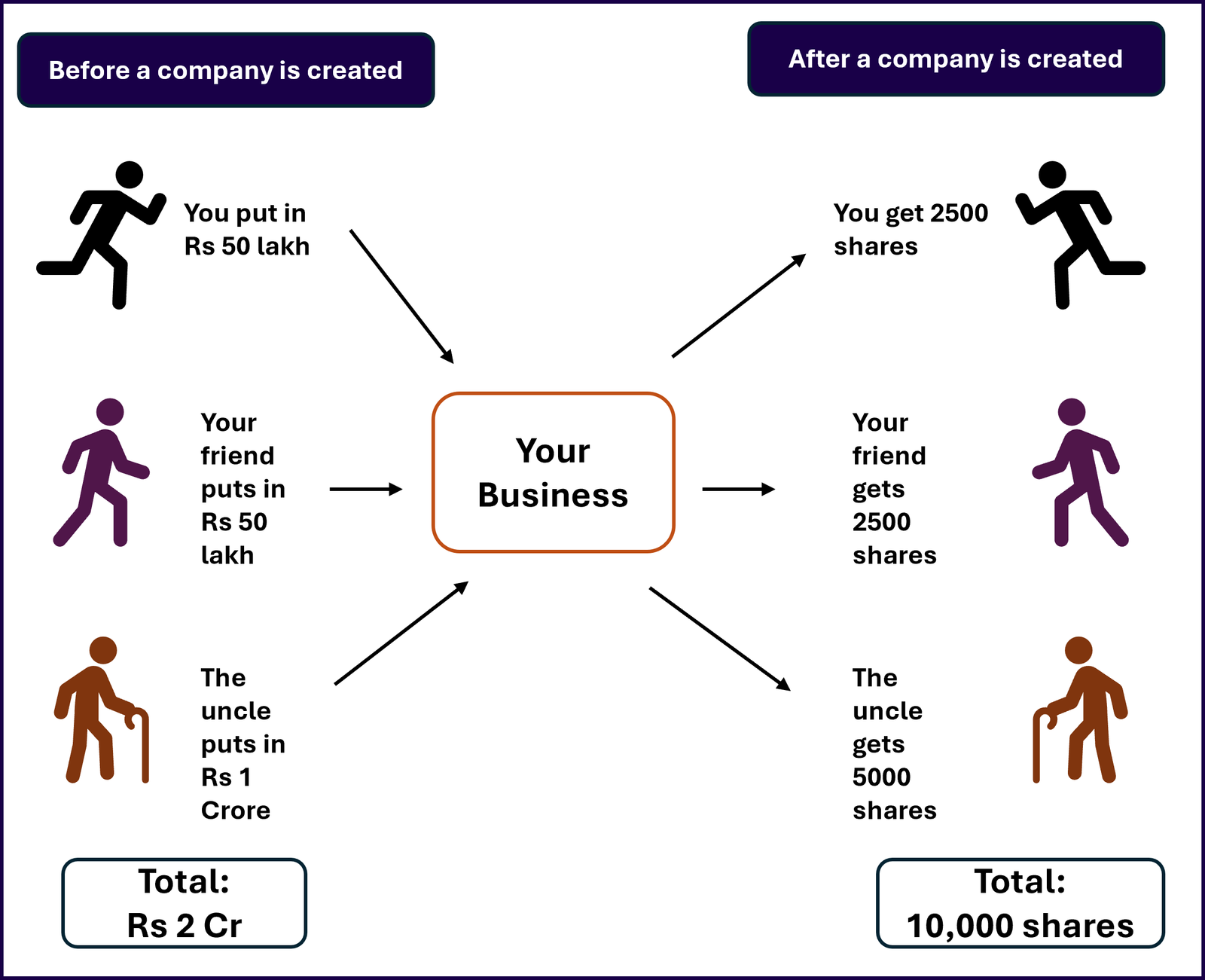

Investment Products

Products are supposed to solve problems. But we have more than we need. Result? Confusion, choice paralysis, regret. Sounds familiar? This section will help you cut the noise and decide what’s right for you.

Investing Maths

Yes, maths. It all boils down to numbers in the end. Numbers clarify, but only if you understand them well.If you don’t, it’s easy to fool you or confuse you. Your only choice? Get better with them! Sorry, but no middle ground here.

Other Things

Think taxation, planning, investing biases, selecting an advisor, and so on. The stuff that you need to look at quarterly, annually or maybe only once your life. But understand this – less frequent does not mean less importance.

Browse posts by your comfort level

Beginner

Head over here if you are like very new to the finance and investing stuff. I will help you get strong and clear with basics here.

Intermediate

If you are someone who can confidently explain CAGR, IRR XIRR, mutual fund types and so on – you should start here. Start your journey towards becoming a pro.

Advanced

Want to talk about rolling returns, dig deeper into the “Why”s of products, and other high level stuff? You’re welcome here. Do not forget to challenge me when you feel like it.